Tell us a little about Shojin Property Partners and its history - how long you’ve been operating and why did you decide to form your company?

Shojin Property Partners was founded in 2009 to enable more people to invest in the real estate sector. And not just buying rental properties, but investing in development projects where the returns can be significant as well.

The company was founded by Jatin Ondhia and Sandeep Puri. Jatin came from an investment banking background and combined his risk analysis and financial structuring skills with Sandeep’s financial and project management expertise from his experiences as a quantity surveyor within the construction sector.

Shojin started as a developer, refurbishing and constructing small units financed by the “friends and family” network. After proving great returns, they moved into larger projects with a wider range of high net worth (HNW) investors and family offices.

By 2016, Jatin and Sandeep noticed that plenty of very good developers were struggling to fund their schemes through lack of experience raising external capital. This created an opportunity to apply Shojin’s detailed due diligence and oversight process to help other developers raise capital through Shojin’s HNW investor network.

With the developments in technology and increasing online consumer activity, Shojin recognized an opportunity to open this up to investors around the world through crowdfunding technology. Shojin was granted an FCA license in September 2017 and was then able to lower the minimum investment size and open these products up to a much greater audience.

How do you find new investment opportunities? What is your vetting process? Are good deals difficult to find?

In the early days, our opportunities mostly originated through relationship building and networking with senior lenders and brokers. Over time though, as we established ourselves as a key market player in the provision of equity and mezzanine finance, many developers now come to us directly with projects for assessment.

Deals are thoroughly vetted by our in-house team before we agree to proceed, at which point all the due diligence is signed off using 3rd party professionals. We co-invest in every project and then oversee the projects from start to finish, including attendance of construction meetings and continuous assessment throughout the project to get an early warning of any risks that may derail the returns for our investors. We make most of our revenue by sharing profits at the end of a project and are therefore fully aligned with investors to ensure a smooth, clean exit from each project. We prefer fewer deals of higher quality and effectively cherry-pick the very best projects out of the thousands with which we are presented.

Are you planning to offer any new types of investments in the near future?

Whilst our core expertise is in the equity and mezzanine tranches of the funding stack for development projects, we have also offered bridge loan opportunities as well as larger buy-and-hold fixed asset investments including student accommodation blocks. We are very opportunistic and look for situations that present outsized returns for the level of risk on the project. We then try to mitigate or reduce those risks further to ensure a smooth project and exit for investors.

How much money have you raised on Shojin Property Partners?

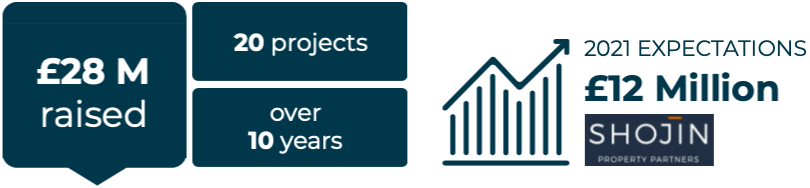

To date, we have raised over £28m from hundreds of investors from over 30 countries to directly fund projects. We have also raised another £10m when you add in diversified investment bonds.

We started raising external funds in 2011 on smaller projects, building up project size over the years. We achieved the FCA license in 2017 to launch this business as an online investment platform and about half the money raised has been since then as our deal size has also increased. Investor funds have been used on about 20 deals to date. We also carry out all the due diligence and oversight in-house, meaning that we only do a handful of deals each year.

How much do you expect to raise in 2021?

Based on our goals and projections, we aim to raise £12m in 2021 with a mixture of development equity and development mezzanine to back over £100m in Gross Development Value (GDV).

Who are your investors? What issues do they face?

Our investor base is formed mostly by the mass affluent demographic - those that have investable funds of £100k-£1m. This is the demographic that we believe is the most underserved in today’s investing ecosystem. Whilst the super-rich have always made and preserved wealth in property, the rising middle classes around the world are looking to emulate this approach to managing their own wealth.

Few have access to private wealth managers, and many are put off by fund managers taking high fees even when they underperform. Generally speaking, they lack the access, knowledge, and capital required to participate, especially in real estate development opportunities.

What is the average return for investors on your platform?

We specialize in development equity and development mezzanine, so the average annualized returns on our projects range from 15% per annum (for mezzanine) to 25% per annum (for equity).

What would you consider to be Shojin’s biggest success so far?

Shojin is one of the few UK fintech platforms in the online p2p/crowdfunding space that is actually profitable. This is the result of focusing the team’s effort on our core skills and disciplines (namely project sourcing and oversight) and outsourcing non-core disciplines (such as technology and marketing). We have also approached this from the junior end of the spectrum and are used to taking an equity-level risk, so our due diligence process has evolved to be one of the best in the industry. Shojin has been fortunate to find its niche in the market.

Do you face any regulatory challenges? What was the impact of the recent FCA regulation changes on the industry? What have been some of the other primary challenges that you have faced?

We have certainly faced regulatory challenges, but the regulations are a good thing overall. The regulators are rightly clamping down on the industry due to some high-profile failures. Investors were being mis-sold investments that were wholly unsuitable for them and where they did not understand the true risks. The FCA’s approach has been to consider all platforms, their operation, capital adequacy, and other factors to ensure that they are comfortable with how the platforms operate. Additionally, the FCA has amended the appropriateness classifications to ensure that restricted investors are not sold high-risk investments. All of this is par for the course in developing a fully functioning online marketplace in alternative investments. While it takes up a lot of time and resources dealing with FCA queries, in the long run, it is better for the growth of the market. It levels the playing field but also provides investors with the idea that someone is at least monitoring this space.

However, having gone through a business cycle, the FCA is now much more focused on ensuring that they have the correct details and level of oversight on firms to avoid the seismic failures of 2019 and 2020. Those firms that emerge from the ashes will be much stronger and stable, which is of course better for investors.

As for the biggest challenge, it’s always balancing the appetite from investors with the level of deal flow. It’s like a see-saw; sometimes you have great deals but few investors, other times tons of investors but few deals. This is where collaboration comes in handy. By working with other high-quality platforms in the industry, we can use the deeper liquidity pool and a broader range of projects to meet the requirements of investors and developers alike.

Finally, what future do you predict for real estate crowdfunding? Trends you are anticipating?

The future of property crowdfunding will definitely see more collaboration and consolidation. The market is far too fragmented right now and to create a more mainstream marketplace there needs to be a deeper pool of liquidity and a much wider set of market participants. This is what we are trying to solve with the development of a marketplace with other key players in the market.

Several companies will also struggle to survive burdened by the heavy costs of regulation, marketing, and operations, and we do expect to see more consolidation which will bring together specialists from different parts of the market to leverage the combined skills but also reduce operating costs.

You can view basic data and information to learn more about Shojin Property Partners on their BrikkApp profile page: Here.

To learn more about real estate crowdfunding, download your free eBook today and receive the tips, insights, and market trends that can help you make the most out of your investments.