Did you know that real estate crowdfunding has the potential to grow at a compounded annual growth rate of 33.4% (CAGR) until 2028? This is an exciting and rapidly growing industry with a vast variety of real estate investment opportunities available to the average investor.

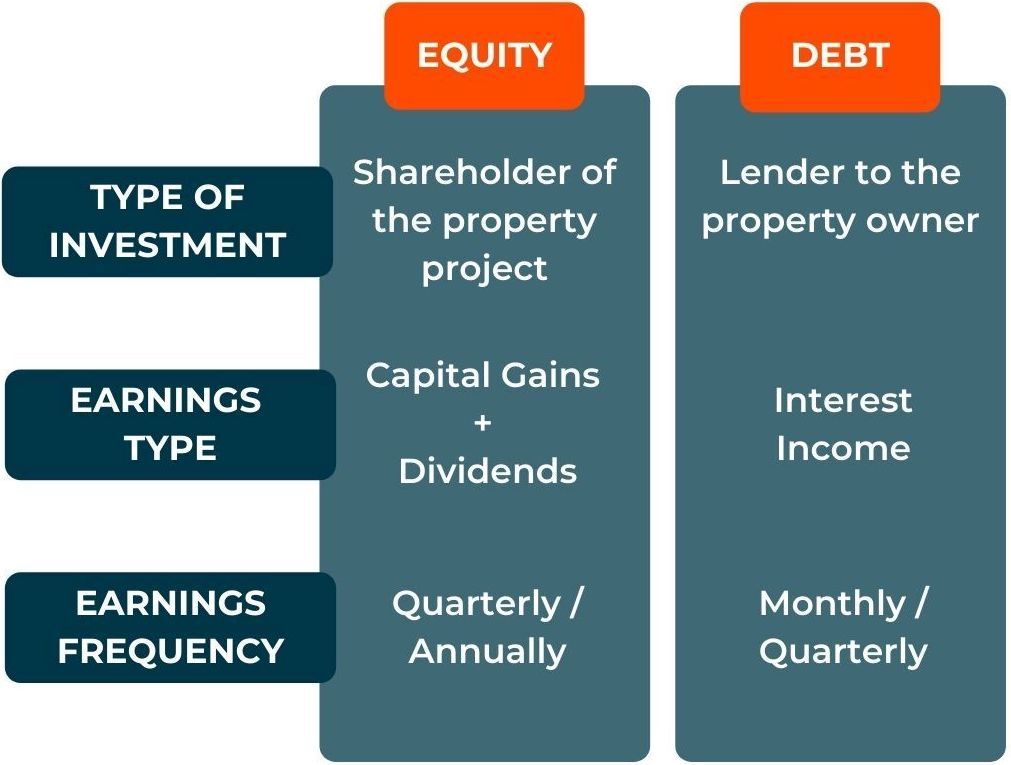

Before diving into this sector and making your first real estate investment, one thing that is important for new real estate crowdfunding investors to learn about is the different types of investments that can be made. The two main and generally used in this industry investment types are debt and equity. Each type will differ in its potential returns, liquidity, and level of risk.

Let’s take a deeper look into the world of real estate crowdfunding to learn more about their differences.

To learn more about real estate crowdfunding, download your free eBook today and receive the tips, insights, and market trends that can help you make the most out of your investments.

Capital Stack

Real estate crowdfunding is only one source of funding for property developers. Typically, developers fund their projects through a combination of their own equity and loans provided by banks or other institutional investors. This multi-tiered funding structure is referred to as the capital stack. The concept serves to evaluate risk, returns, and to more accurately assess investment opportunities.

The capital stack is a visual representation of all funding involved in a project and shows the different types of capital sources “stacked” on top of one another. So one project might have funding from a bank, funding from a crowdfunding platform, and funding from the developers themselves. All capital providers will have different legal claims, risk levels, and returns, from the project. This stack of funding is the capital stack.

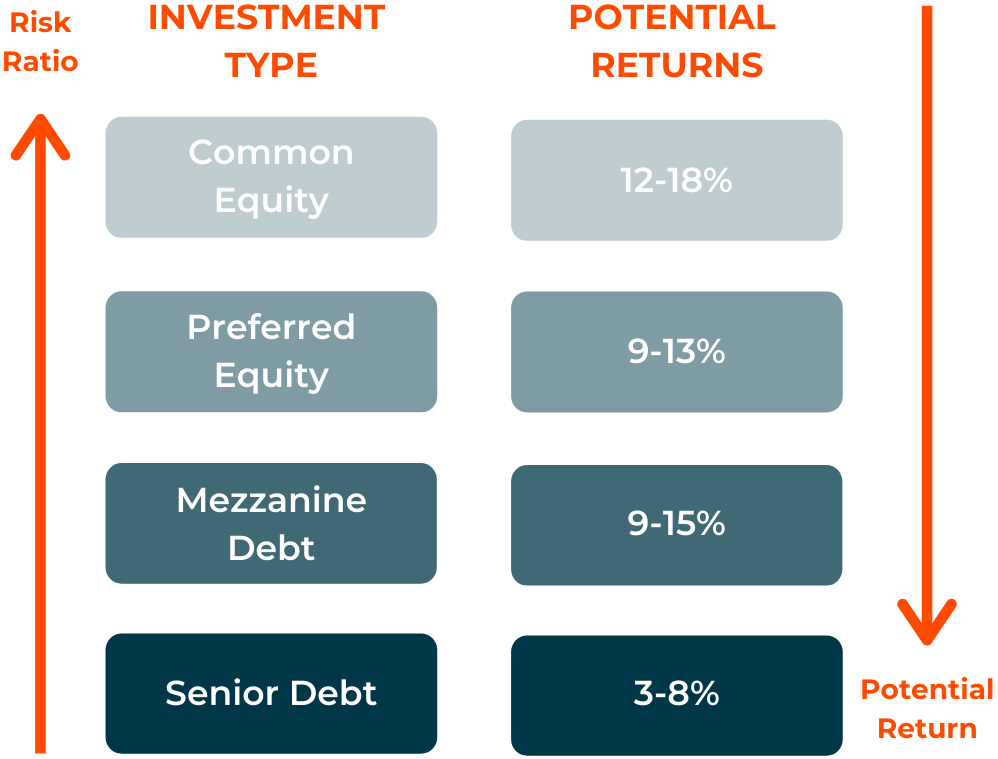

The capital stack is ordered from the least senior capital sources on the top to the most senior sources on the bottom. This determines the priority for distributing the cash flows from the project. In the situation where a project runs into financial difficulties, the capital stack helps visualize which lenders are paid back first and in what amounts. Debt investors are typically first to receive cash flows from a project, while equity investors are last.

Thus it's the capital stacks that show the correlation between the level of risk and the amount of potential return: The higher you go in the pyramid, the higher return you can expect – but at a higher risk.

Debt Investments

Debt is the most common type of real estate crowdfunding investment. Based on our research and analysis, approximately 90% of real estate crowdfunding projects are debt investments. There are many different investment types that are considered debt in this industry, including bridging, development, bullet, and other types of loans or bond products. Investors act as lenders to the real estate project owner, typically investing and providing funding for a loan associated with the property.

With debt investments, holding periods, or the length of the investment, are typically shorter than equity investments. Investment periods are typically 6 to 24 months in length and investors earn interest over the time of the loan.

There are two different types of debt funding within the capital stack:

The first is Senior Debt. Senior debt is the first source of capital that property developers and sponsors raise when funding a project. Typically this funding is provided by banks or other large financial institutional investors. If a project gets into financial problems, senior debt has the highest priority for repayment compared to mezzanine (non-senior) debt and equity investments, which is why it is typically the safest investment in real estate crowdfunding. In turn, returns for senior debt investments are typically the lowest. Investors can expect a return of 3 - 8%.

The second is Mezzanine Debt aka Junior Debt. Mezzanine (junior) debt forms a bridge between debt and equity investments. Investors stand in the repayment line behind senior debt investors, but have priority before equity investors. Mezzanine debt investments are therefore riskier than senior debt investments, with a higher return. Returns of 9 - 15% are typical.

Equity Investments

At the top of the capital stack are equity investments. An equity investment typically means an investor will provide funding for a developer or property owner and then own a proportional share of the real estate project. Returns are based on the property rental income and changes in the value of the property project.

Although it's not always the case, equity investors generally receive higher returns than debt investors due to the increased level of risk that they take. Earnings are derived from rental income on a periodic basis and any proportional capital gains once the property is sold.

Equity investments are generally associated with higher risk and longer holding periods. While platforms usually offer a possibility to sell the investment after five years, the period can stretch to up to ten or more years, which makes these investments inherently less liquid than shorter-term debt investments.

There are two different types of equity funding within the capital stack:

The first is preferred equity. Preferred equity provides sponsors and developers with a higher degree of leverage at a lower cost than in common equity. Preferred equity allows investors to receive payments before common equity holders and also a proportional share of the total capital gain of a project. It has seniority to common equity and therefore a lower rate of return to match. Returns on investment will typically be 9 - 13%.

The second type of equity investment and top of the capital stack is common equity. This has the highest risk of all funding sponsors due to being the last to be repaid from the project’s cash flows. The good news for common equity investors is that this leads to the highest returns. Common equity investments can have returns of 12 - 18%.

Equity vs. Debt

In real estate crowdfunding, the capital stack is an important aspect to consider when investing. Chosen investments will belong within these categories and their placement will have a large impact on risk, returns, holding periods, and ownership rights. Debt investments are typically less risky, while equity investments will typically have higher returns. It is up to the investor’s preference and risk tolerance when choosing which investment type is right for them.

BrikkApp presents all information related to a platform’s investment types and access to data from across the real estate crowdfunding market. Start researching platforms today with our industry-leading Crowdscanner!