In the world of investing, there is a lot of jargon, acronyms, and technical terms. NPV, APR, APY, bonds, diversification, capital gains, equity... The list goes on and on. It can be difficult for even experienced investors to remember every term and every use case for it.

With investing in real estate, another set of vocabulary must be added to an investor’s lexicon. In this article, we will explain one of the more important terms, loan-to-value or LTV, and what it means, how to use it, and why it is an important metric to consider for real estate crowdfunding investors.

Learn about the different types of investments in real estate crowdfunding with this article.

What is Loan-to-Value?

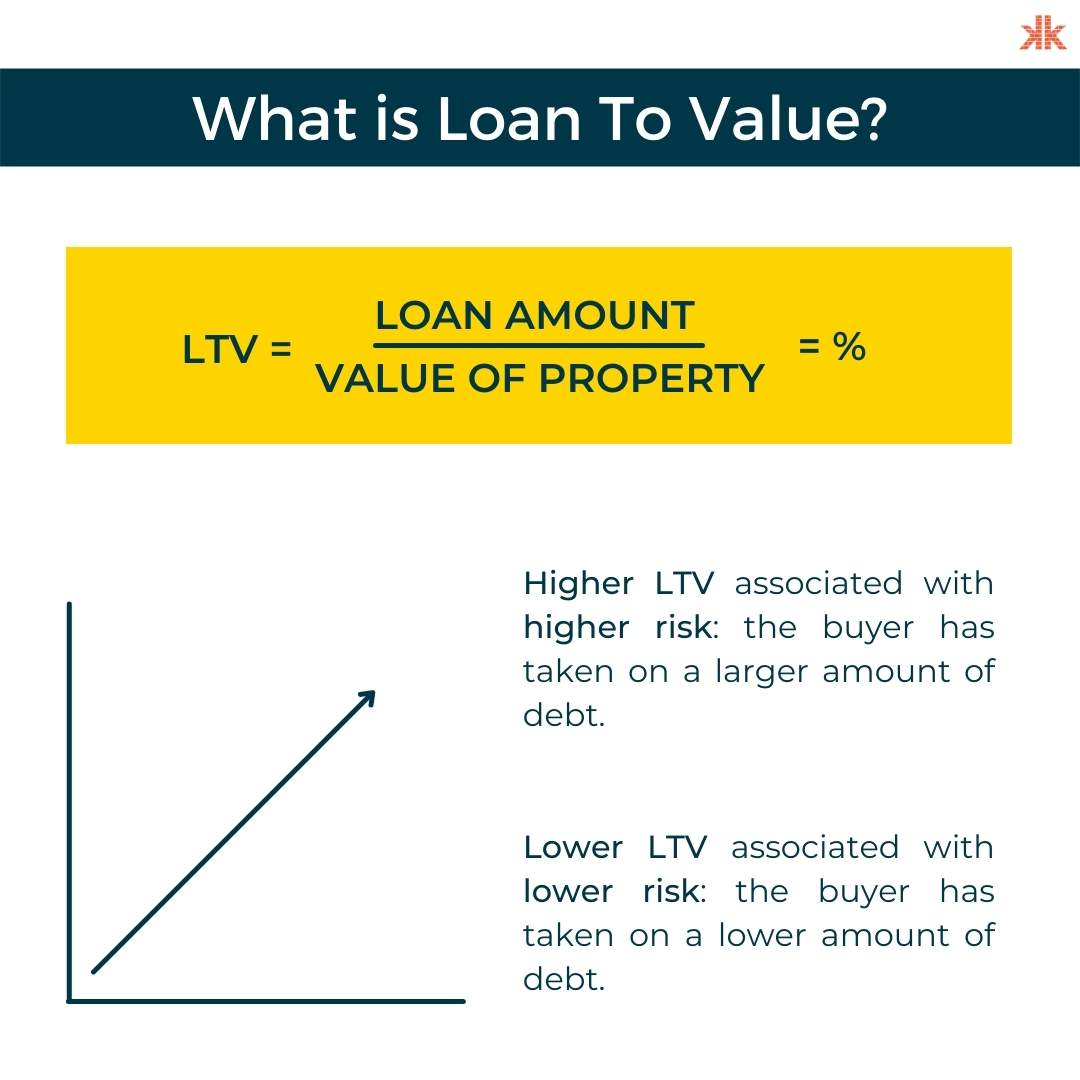

Loan-to-Value is a financial metric that is typically expressed as a percentage. It looks at the ratio of all the loans compared to the value of the asset the loan is for. It is calculated by dividing the loan amount by the (typically appraised) value of the property.

In mathematical terms, it looks like:

LTV = Loan Amount / Value

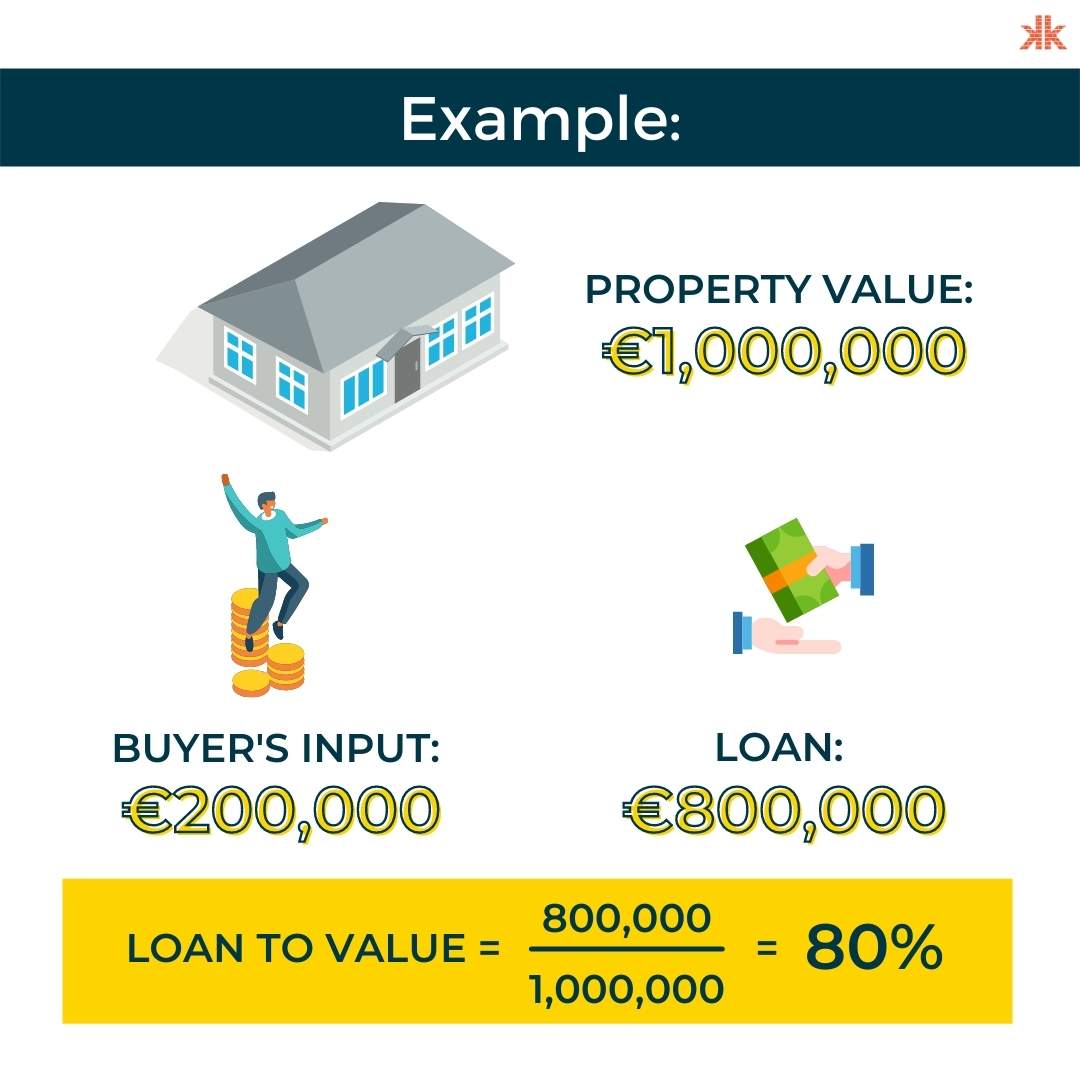

For example, a property has a value of €1,000,000. A prospective buyer wants to purchase the property. The buyer has €200,000 in cash and therefore needs a loan of €800,000 to pay for the property. This results in the loan having an LTV of 80% (800,000 / 1,000,000).

LTV is typically used as a risk metric. A higher LTV is associated with higher risk because the buyer has taken on a larger amount of debt in order to acquire the property. Typically, the more debt, the more risk is involved due to the size of the obligation. If financial issues arise, the borrower is a lot more likely to be able to pay off a €10,000 loan rather than a €1,000,000 loan. The reverse is also true, with a lower LTV being associated with lower risk because of the lower amount of debt the buyer has taken on to acquire the property.

Ok, so that’s LTV… what about LTGDV?

Loan-to-value (LTV) should not be confused with loan-to-gross-development-value (LTGDV). While it is a similar measurement, LTV is calculated using the value of the property at the beginning of the investment, while LTGDV is using the value of the property at the point of exit. As property prices rarely stay stagnant, this is an important distinction. The value of the property will be heavily impacted by whatever development occurs to it.

LTV is important for understanding the chances of recovering your investment in case the development fails, while LTGDV is most relevant at the end of the investment when it comes to sale or exit.

Learn more about real estate crowdfunding terms with our glossary!

So how does this apply to me?

Understanding LTV is key for real estate investors. It is both an indication of risk and a signal of how much debt was used to finance a property. For example, a real estate crowdfunding platform might try to fund a developer’s real estate project. This project requires €200,000 of financing from investors registered on the platform. The loan has an LTV of 55%. Investors on the platform are now lenders to the developers for a property valued at approximately €364,000. In the event of a default, this value is the total possible amount that could be returned to stakeholders.

Additionally, property values change due to a variety of factors and the value of the property could decrease. If a loan has a high LTV (85%+) and the property value decreases, it could cause the loan to be worth more than the property. This means even if the asset was sold, the debt obligation would not be fulfilled.

Essentially, LTV is a measure of the amount of safety an investor has when investing in a property. The lower the LTV, the larger the security, and vice versa. It means in a worst-case scenario like a default, investors have an idea of the likelihood capital will be returned to them.

LTV is an important metric, but as with most financial metrics, does not tell the entire story. Investors should always perform their due diligence and attempt to learn as much as possible about their potential investments in order to protect themselves from risks.