There are no two ways about it - crowdlending is here to stay. And it’s not just BrikkApp, either - companies like Reinvest24 have been making waves, too, and for good reason - they’re led by an expert team with significant industry experience and operating out of Estonia, possibly the most exciting economy to watch in the Baltics.

We wanted to sit down with the CEO of Reinvest24, Tanel Orro, and discuss the industry at large, Reinvest24’s unique approach to the field, what they have already achieved, and what they’re aiming for in 2021.

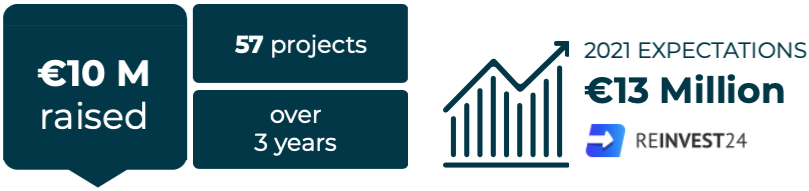

The Estonian company has only been operating since 2018, but in that time, they’ve already managed to raise more than €10M, continued growing despite the ongoing pandemic, expanded their database to include over 9000 individual investors, and much more.

We thought it was worth checking in on Tanel and Reinvest24’s current goings-on to get a better picture of how they achieved this.

Tell me a little about Reinvest24 and its history - how long you’ve been operating and why did you decide to form your company?

“Although I am not the founder of the platform, I have been involved as CEO since day 1 and helped the platform develop and find suitable investors.

They say that great businesses start either with a dream or a current problem solution. Reinvest24’s story started with both.

The idea of creating the company appeared from our own needs. First of all, we were and still are passionate investors ourselves. In 2015, we started to buy, manage and develop several real estate projects in Estonia, for a total value of 10 million EUR.

After several successful, as well as not-so-successful projects, our high-net-worth individual contacts started to become interested in [real estate crowdfunding], how we do it, and how to participate in it as well. Then we saw a big gap - real estate investing always goes hand in hand with requiring a large amount of capital and overall market knowledge. We thought, ‘How great it would be if you could have the same benefits as owning your real estate, without having the headaches that landlords usually have, and you could still start with only 100 EUR?’ The answer was simple, let's not wait until something happens someday and rather be the change we seek.”

Despite the platform being only a few years old, the team has already made it possible to invest in a wide variety of properties, secured with 1st rank mortgage, and still earn up to 16.8% IRR from 4 different European markets (Latvia, Moldova, Spain, and Estonia).

How popular is real estate crowdfunding in Estonia and the greater Baltic region?

“I would say that real estate crowdfunding in Estonia is quite attractive, as the first real estate platform, Crowdestate, as well as the biggest in Europe to date, Estateguru, come from here.

We have the majority of our rental projects in Estonia as the country has had the best performing rental yield in the EU zone with 5-8%. Besides, the real estate prices in Tallinn increased even in the time of COVID by 6.9% in 2020. Therefore, we see many opportunities that start to attract even professional investors.”

As for the Baltics, the whole region’s economy is growing faster than ever before; we’ve been seeing rapid growth in the real estate sector in part owing to the comparative lack of competition in the industry. Overall the region has seen an increase in salaries and a consistent economic growth of up to 4.2% year-over-year.

This has resulted in Estonia, Latvia, and Lithuania being dubbed “The Baltic Tiger”, regularly seeing the fastest growth in the entire eurozone. Between 2000 and 2007 alone, the region saw immense growth rates, some of the highest in all of Europe.

As far as Reinvest24 goes, the company originally started by offering rental properties in Tallinn. As of today, they have made it possible to invest in secured real estate projects with an average Loan-To-Value equal to lower than 50% from the 4 previously mentioned countries, encompassing 3 different investment types (development, rental, and real estate-backed loans).

How much do you expect to raise in 2021? Who are your investors? Where do they come from?

“Since its inception, we have raised 10 million EUR. Currently, the Reinvest24 platform offers to invest in those 3 real estate investment types - development and rental projects, as well as real-estate-backed loans.

Last year we showed great performance - expanded to new markets and new investment types, implemented new features and strengthened our product overall.

This year we expect to raise 13 million EUR and become a more serious market player in the European Region.“

Tanel notes that as of right now, Reinvest24 caters to investors who prefer secured real estate investments for long-term passive income. While their investors come from all over Europe, the majority of investments come from Germany, Denmark, Estonia, Spain, and the Netherlands.

“Recently we noticed a growing interest in our platform from many professional investors, as they value us as the easiest gateway to the Moldovan real estate market. Currently, Moldova is a developing country that faces important changes, which could bring outstanding and high-yielding opportunities in terms of real estate investing. To be honest, we have started to see this growth already, as some of our current funding projects started to grow by more than 20%. And in terms of Moldovan real estate, this growth is healthy, as the overall economy is growing as well, not just one sector.”

Related: What’s Next for Real Estate Investors in 2021?

What would you consider to be Reinvest24’s biggest success so far?

“Reinvest24's biggest success is our wise risk management and efficient teamwork. Thanks to that, we were able to show great performance even during the COVID-19 pandemic, exiting 5 projects and generating an average return of 14.8% per annum. Also right now is a very meaningful time for the platform, as we are successfully exiting 4 projects in 1 month, paying back more than 1 million EUR to our investors.”

Tanel emphasizes that many investors and most reputable industry publishers confirm that Reinvest24 secondary market, which was launched last year, is one the most outstanding secondary markets currently available within the industry.

“For example, now investors can reinvest their monthly payouts, starting from 1 EUR, thus increasing their returns overall. As per our rental projects, the income for the whole month will go to the user who holds the claim unit at the time of the income payout. For example, the seller owned claim units for 29 days, and the buyer owned them for 1 full day of the month, in this case, the buyer will receive all the dividends accrued during that month. I believe mathematics says it all.”

Among Reinvest24’s many accomplishments is the team’s high pedigree. Reinvest24 is not the first rodeo for most people within the company, something that manifests at every stage of its operations.

While the team is quite small, the company’s success speaks to its effectiveness.

As Tanel adds, “All our employees come from the financial sector - either banks, stock trading, or fintech. People like them, you normally describe as the ones that can change the world and drive innovations. Sometimes I receive notifications at night simply because great ideas couldn't wait until morning. Many of us work remotely from different countries. For example, our Support Manager provides outstanding customer care from Lithuania, the Head of Marketing makes her magic from Tenerife, and our IT writes the codes from Latvia. ”

What future do you predict for real estate crowdfunding? Are there any specific trends that you foresee in the next 2-3 years?

“Taking into account that the long-awaited EU regulation will come into force later this year, it will strengthen the alternative investment industry overall. By that, I mean there will be fewer market participants, but those who stay will become the masters of their products and the services they provide. Also, retail investors will become more educated in terms of real estate crowdfunding and the various risks that are associated with this type of investment.”

The company’s CEO also goes on to mention the ongoing trend of lowering interest rates. Many factors should be taken into account when evaluating the high-interest rates.

“In our case, we are currently able to offer returns up to 16% because we are working on developing markets, with big potential for capital growth, as well as developing the majority of projects by ourselves, and thus, lowering the expenses as much as possible. In the long run, we believe that interest rates will go down, although as for now, this is more of an outstanding opportunity, rather than a sustainable paradigm, that is here to stay.”

Does Reinvest24 have any plans to expand further abroad?

“Yes, we do. Last year we expanded massively and started offering investments into the real estate markets of Latvia, Moldova, and Spain. In January this year, we announced the opening of our first international branch in Spain. And as we continue to refuse to stand still, we are already working on offering real estate investments from even more European countries.

Apart from that, I would like to stress that Reinvest24 has always been a very conservative platform that has focused on quality rather than quantity. This approach especially proved itself in times of Covid, as none of our properties have defaulted or faced any major issues. And for that reason and many others listed previously, we are planning to strengthen and carry beyond time.”

You can view basic data and information to learn more about Reinvest24 on their BrikkApp profile page: Here.

“To learn more about real estate crowdfunding, download your free eBook today and receive the tips, insights, and market trends that can help you make the most out of your investments.”